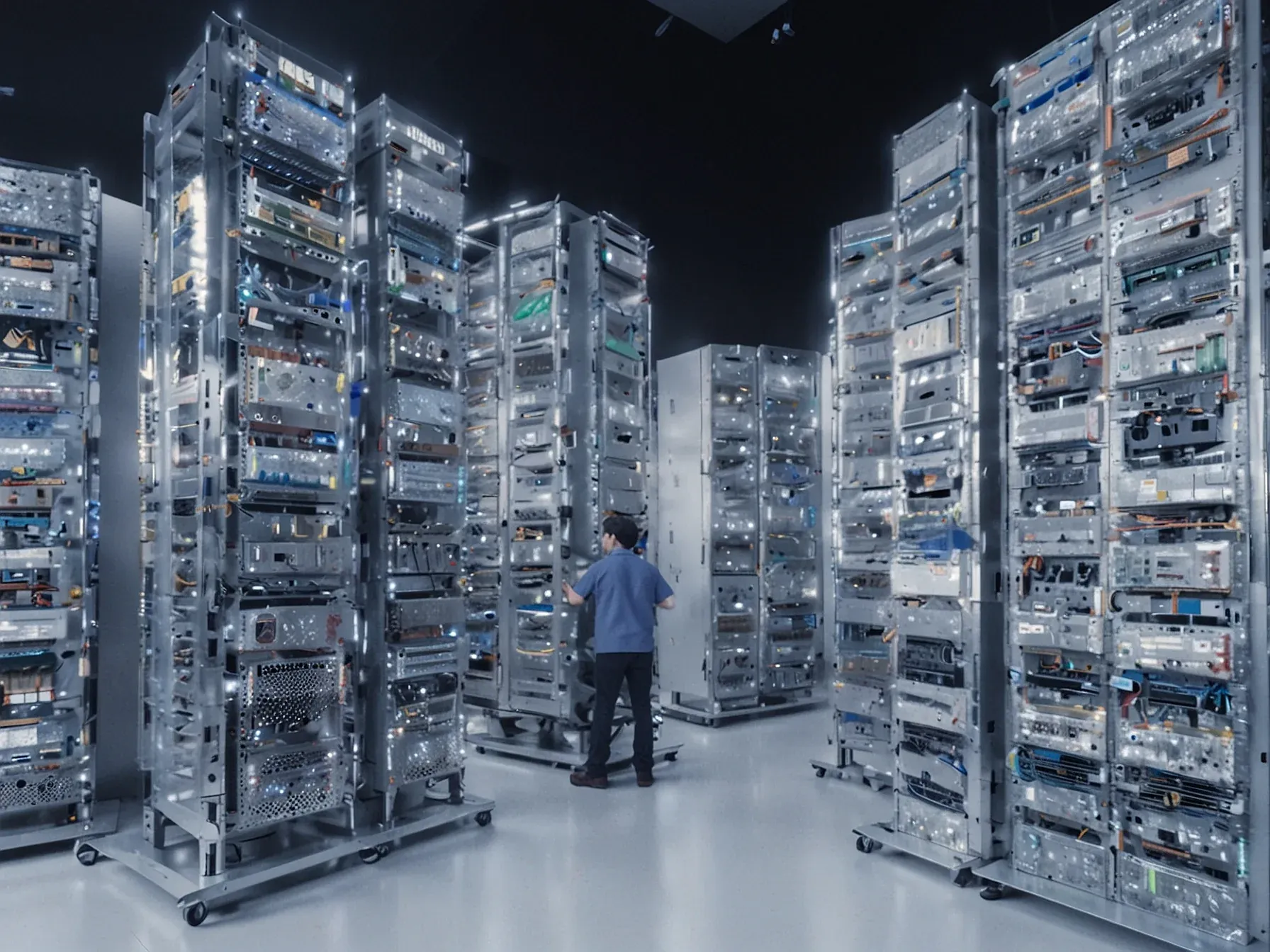

Editorial illustration for Meta Negotiates Up to One Million Google TPUs to Challenge NVIDIA's AI Chip Dominance

Meta's Million-TPU Deal Challenges NVIDIA's AI Chip Empire

Meta Eyes Google TPUs, Up to One Million Units, as NVIDIA Alternative

Meta is making a bold play to break NVIDIA's stranglehold on AI computing infrastructure. The social media giant is reportedly in advanced negotiations with Google to secure up to one million tensor processing units (TPUs), signaling a strategic push to diversify its high-performance chip supply.

This potential partnership represents more than just a hardware deal. It's a calculated move that could reshape the competitive landscape of AI chip manufacturing, challenging NVIDIA's dominant market position.

With Meta's massive planned capital expenditure approaching $100 billion by 2026, the company is clearly willing to make substantial investments to gain technological independence. The negotiations suggest a growing appetite among big tech firms to reduce reliance on a single chip supplier.

Google's TPUs have already proven attractive to other AI companies, with a recent agreement to supply Anthropic highlighting their emerging credibility in the market. For Meta, securing a comparable arrangement could be a game-changing strategic maneuver in the increasingly complex world of AI infrastructure.

If finalised, the Meta-Google arrangement would bolster TPUs as a credible alternative in high-performance AI computing. Google has already signed a separate agreement to provide up to one million TPUs to Anthropic. With Meta's capital expenditure projected to exceed $100 billion in 2026, Bloomberg analysts estimate the company could spend $40-$50 billion next year on inferencing-chip capacity alone, potentially accelerating demand for Google Cloud services.

TPUs, designed more than a decade ago specifically for AI workloads, have gained traction as companies evaluate customised, power-efficient alternatives to traditional GPUs. While NVIDIA still commands the vast majority of the AI chip market and AMD remains a distant second, TPUs are emerging as a strong contender, especially as companies seek to mitigate reliance on a single dominant supplier.

Meta's potential deal with Google for up to one million TPUs signals a significant strategic move in the AI computing landscape. The arrangement could fundamentally challenge NVIDIA's current chip market dominance.

Google's TPUs have already proven attractive, with a similar agreement recently struck with Anthropic. Meta's massive projected capital expenditure, potentially reaching $100 billion by 2026, underscores the company's serious investment in alternative AI infrastructure.

The negotiations suggest Meta is aggressively diversifying its computing options. Bloomberg analysts estimate the company might spend $40-$50 billion next year specifically on inferencing-chip capacity, indicating a substantial commitment to expanding AI computational power.

This potential partnership highlights the growing competition in high-performance AI computing. By exploring Google's TPU technology, Meta is positioning itself to reduce dependency on a single chip provider and potentially lower infrastructure costs.

While the deal isn't finalized, it represents a bold strategic approach. The outcome could reshape how major tech companies approach AI computational resources, introducing meaningful competition in a previously concentrated market.

Further Reading

- 2026 AI landscape who benefits the most? - Uncover Alpha

- Google's Answer to the Question of Nvidia's CUDA ... - CIO.inc

- Nvidia resets the economics of AI factories, again - SiliconANGLE

Common Questions Answered

How many TPUs is Meta negotiating to acquire from Google?

Meta is in advanced negotiations to secure up to one million tensor processing units (TPUs) from Google. This massive potential acquisition represents a strategic move to diversify its AI computing infrastructure and challenge NVIDIA's market dominance.

What is the significance of Meta's potential TPU deal with Google?

The deal represents a calculated effort to break NVIDIA's stranglehold on AI computing infrastructure by introducing a credible alternative through Google's TPUs. With Meta's projected capital expenditure potentially reaching $100 billion by 2026, this partnership could fundamentally reshape the competitive landscape of AI chip manufacturing.

How much might Meta spend on inferencing-chip capacity in the coming year?

Bloomberg analysts estimate that Meta could spend between $40-$50 billion next year on inferencing-chip capacity alone. This significant investment underscores the company's commitment to expanding and diversifying its AI computing resources.